An individual's financial standing, often quantified by the total value of assets minus liabilities, is a crucial element in understanding their overall economic position. This figure, in the context of a prominent public figure like a professional golfer, can provide insights into career earnings, investment success, and lifestyle choices. The financial circumstances of high-profile individuals are frequently of interest to the public, as they offer a glimpse into the potential rewards of various careers and endeavors.

Understanding the financial standing of individuals like Kevin Harrington allows for a broader perspective on the economic realities of specific professions. The public often seeks to understand how successful individuals in specific fields achieve their wealth. Historical data on wealth accumulation can provide valuable context for aspiring professionals and investors, highlighting the factors contributing to financial success. This kind of analysis, while not definitively predictive, can offer a frame of reference and inform future strategic considerations.

A comprehensive examination of Harrington's financial history would require in-depth analysis of his career earnings, investment portfolios, and personal spending habits. This would be valuable background material, and such an exploration might reveal insights relevant to successful career paths in professional sports. Further research into this topic could be informative for understanding the factors that impact the accumulation of wealth.

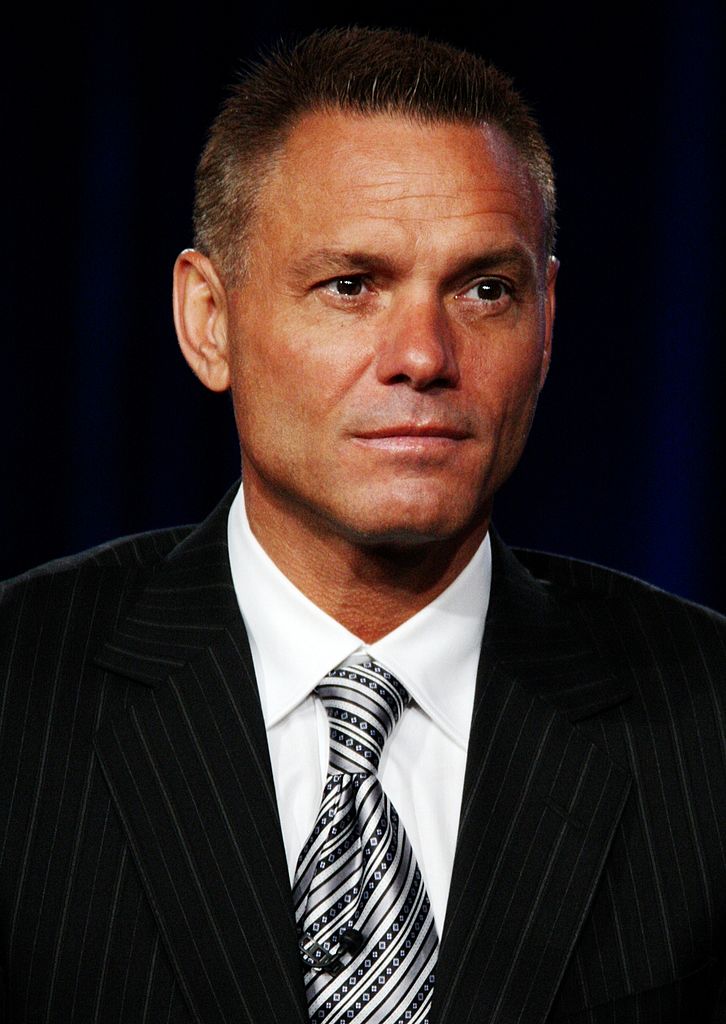

Kevin Harrington Net Worth

Understanding Kevin Harrington's financial standing provides insight into factors influencing wealth accumulation. This analysis considers key aspects of his financial situation, including income sources, assets, and expenses.

- Earnings

- Investments

- Assets

- Expenses

- Lifestyle

- Career Trajectory

- Public Perception

Kevin Harrington's earnings, derived from his professional career, are a significant element in determining his net worth. Successful investment strategies and the acquisition of valuable assets further contribute. Lifestyle choices impact expenses, while career trajectory influences earning potential over time. Public perception, although not a direct financial component, can indirectly affect investment opportunities and overall value. Analyzing these aspects together reveals a more comprehensive picture of wealth creation and maintenance. For example, a consistently high-earning professional with significant investments and prudent spending can accumulate substantial wealth over time. This contrasts with someone with similar earnings but less effective asset management. These factors, in conjunction, form a complex picture of financial success.

1. Earnings

Earnings represent a crucial component in determining Kevin Harrington's overall financial standing. Understanding the nature and magnitude of his income streams is essential to appreciating the factors contributing to his net worth. This section examines the various facets of earnings, illustrating their significance within the broader context of wealth accumulation.

- Sources of Income

Different sources of income can significantly impact net worth. Analysis of Harrington's earnings should consider primary income from his profession, any secondary income streams like investments, and potential passive income generated through assets. Identifying the relative contributions of each income source offers insights into the structure of his overall financial portfolio.

- Consistency and Stability

The consistency and stability of income sources are critical factors in long-term wealth accumulation. Regular and predictable income allows for financial planning and investment opportunities. Fluctuating income, while potentially higher in some periods, may present challenges in achieving consistent wealth growth.

- Earning Potential over Time

Assessing earnings over a period of time provides insight into career progression and the potential for future income generation. Analyzing historical patterns can offer valuable information on the growth trajectory of Harrington's income streams and the factors contributing to such growth. Such analysis is crucial for projecting future financial standing.

- Impact of Inflation and Economic Conditions

The purchasing power of earnings can be impacted by inflation and economic fluctuations. Understanding the impact of economic conditions on Harrington's income is crucial for assessing the real value of his earnings. This involves considering the relative strength of his income versus inflation and other economic forces.

In conclusion, understanding the different components of Kevin Harrington's earnings, including their sources, stability, potential, and susceptibility to economic fluctuations, provides a crucial facet in comprehending the underlying drivers behind his financial standing and net worth. A deeper investigation of these facets allows for a more comprehensive evaluation of the complexities involved in accumulating and maintaining substantial wealth.

2. Investments

Investments play a significant role in shaping an individual's net worth. They represent a crucial component in wealth creation and preservation. Successful investment strategies, by generating returns, can augment income and contribute meaningfully to a substantial net worth. Conversely, poor investment choices can erode capital and negatively impact overall financial standing. This dynamic highlights the importance of prudent investment decisions in achieving and maintaining financial security.

The relationship between investments and net worth is multifaceted. A diversified investment portfolio, encompassing various asset classes like stocks, bonds, real estate, and potentially alternative investments, can yield significant returns over time. The success of these investments is often influenced by market conditions and the skill of the investor. Well-executed investment strategies can enhance returns, leading to increased net worth. Conversely, poorly managed investments can lead to capital loss and a decline in overall financial standing. Examples of successful investment strategies in the context of prominent individuals illustrate the potential for substantial growth through calculated risk-taking. This is further demonstrated by the diverse portfolios of successful entrepreneurs and investors.

Understanding the connection between investments and net worth is crucial for individuals seeking to build and preserve wealth. A thorough analysis of investment strategies, including risk assessment and portfolio diversification, is vital. A deep dive into the historical performance of different investment avenues in various economic landscapes provides further context for informed investment decision-making. The potential risks and rewards of different investment strategies must be weighed against realistic financial goals. This approach can translate into more intelligent decision-making and contribute to a more sustainable and successful financial journey. Understanding the potential for long-term growth and mitigating potential risks is crucial for building a robust investment portfolio aligned with one's financial objectives and risk tolerance. This knowledge informs strategies that enhance financial security and future prosperity.

3. Assets

Assets are a crucial component in determining an individual's net worth. They represent ownership of valuable items or resources that hold monetary value. Analyzing an individual's assets provides insight into financial holdings and the potential for future growth or income generation. A thorough examination of assets, considering their types and valuations, is vital for a comprehensive understanding of financial standing.

- Tangible Assets

Tangible assets represent physical items with a readily discernible value. Examples include real estate holdings, vehicles, and personal possessions of significant value. The value of these assets can fluctuate depending on market conditions, demand, and maintenance. In the case of high-profile individuals like Kevin Harrington, valuable assets may include homes, luxury vehicles, or even collections. Accurate valuation of these assets is crucial in calculating net worth.

- Intangible Assets

Intangible assets represent non-physical items holding monetary value. Intellectual property, patents, copyrights, and brand recognition fall under this category. Their valuation can be complex, often relying on expert appraisal and market analysis. For individuals in creative fields or those with established brands, intangible assets can be significant factors in their overall net worth. For instance, Kevin Harrington's brand recognition, if valuable, could contribute to intangible asset value. However, the quantification of intangible assets can often prove more challenging than evaluating tangible assets.

- Investment Assets

Investment assets include stocks, bonds, mutual funds, and other financial instruments. These assets represent financial holdings designed to generate income or capital appreciation. The performance of investment assets is often influenced by market fluctuations and economic conditions. Investors can achieve significant gains from carefully selected and well-managed investment assets. Successful and well-diversified investment portfolios are often critical for increasing and preserving net worth. Investments made by Kevin Harrington are relevant to understanding his total financial situation.

- Liquidity of Assets

The ease with which assets can be converted into cash is crucial. Liquid assets can be quickly exchanged for cash, providing ready access to funds. Real estate, though valuable, often takes time to liquidate compared to readily convertible assets. Liquidity is important in financial emergencies or when taking advantage of favorable investment opportunities. This aspect is important in understanding the practicality and implications of various assets held by an individual. Evaluating the liquidity of Harrington's assets helps in determining how easily he could access funds for various purposes.

In summary, understanding the types, values, and liquidity of assets is integral to evaluating an individual's net worth. Kevin Harrington's asset holdings, whether tangible, intangible, or investment-based, contribute significantly to his overall financial standing and demonstrate the interconnectedness of assets and his total financial picture.

4. Expenses

Expenses directly influence an individual's net worth. They represent the costs incurred in maintaining a lifestyle and pursuing various endeavors. Control over expenses is a crucial factor in wealth accumulation. High expenses relative to income can diminish net worth, while prudent expense management can bolster it. A detailed analysis of expenses provides insight into an individual's financial priorities and spending habits. For instance, an individual with significant expenses in luxury goods and services may show a slower increase in net worth compared to someone with a similar income but lower discretionary spending.

The relationship between expenses and net worth is fundamental. Expenses act as a counterbalance to income, directly affecting the final calculation of net worth. Managing expenses efficiently involves identifying areas for reduction and prioritizing spending. This may involve reducing costs in housing, transportation, or entertainment to free up capital for investment and growth. Examples of individuals demonstrating successful expense management include high-net-worth individuals who allocate a substantial portion of their income to investments, thereby maximizing returns and wealth creation. This illustrates that minimizing unnecessary expenditures is a cornerstone of wealth management. The concept of living below one's means is often highlighted as a key principle in securing a stable financial future. Analyzing expenditure patterns can provide valuable insight into individual financial priorities and spending habits. This analysis informs decisions concerning investments, savings, and financial planning.

In conclusion, expenses are a significant component of determining and maintaining an individual's net worth. Analyzing expense patterns reveals crucial insights into financial habits and priorities. Effective expense management is a vital part of achieving long-term financial security. By understanding the relationship between expenses and income, individuals can strategically manage their finances, fostering wealth accumulation and minimizing financial strain. This principle applies across various socioeconomic levels, emphasizing the importance of financial literacy in creating and sustaining financial well-being.

5. Lifestyle

Lifestyle choices, encompassing spending habits, priorities, and consumption patterns, directly correlate with net worth. Analysis of lifestyle choices provides insight into the spending behaviors that contribute to, or detract from, overall financial standing. The link between lifestyle and net worth is not a direct equation, but a significant contributing factor. Significant disparities in spending patterns between individuals with comparable incomes often reflect differing priorities and levels of wealth management.

- Spending Priorities

The allocation of resources reflects underlying priorities and values. Choices related to housing, transportation, entertainment, and personal expenditures influence the financial trajectory. Individuals with a focus on experiences over material possessions may have different spending patterns and, consequently, potentially different levels of accumulated wealth compared to those prioritizing material possessions. This difference in spending priorities affects the rate of wealth accumulation, influencing net worth over time.

- Savings and Investment Habits

Savings and investment habits are integral components of a financially sound lifestyle. Consistency in saving a portion of income, coupled with strategic investment choices, often correlates with increasing net worth. Conversely, a lifestyle prioritizing immediate gratification over long-term financial security may result in limited savings and investment opportunities. The impact of these habits on accumulating wealth is noteworthy.

- Debt Management

Managing debt effectively is crucial in maintaining financial stability. High levels of debt can strain finances and limit opportunities for investment and wealth building. Individuals who prioritize debt reduction and minimize high-interest debt tend to show better financial outcomes and potentially greater accumulation of wealth over time, as their disposable income is enhanced. The impact of debt on financial health is a critical consideration when evaluating the factors influencing net worth.

- Consumption Patterns

Consumption patterns directly relate to expenses and overall financial health. A lifestyle characterized by minimizing unnecessary consumption and prioritizing essential needs often reflects a greater capacity for savings and investment. Conversely, a pattern of conspicuous consumption, prioritizing non-essential items, can affect the overall financial health and potentially reduce the rate of wealth accumulation. Such consumption patterns often impact the balance between expenses and income.

In conclusion, lifestyle choices are interwoven with net worth. Analysis of spending priorities, saving habits, debt management, and consumption patterns provides context for the factors that contribute to wealth creation or its constraint. These factors illuminate the crucial connection between the way an individual lives and their overall financial well-being. Understanding these aspects allows a more nuanced evaluation of the numerous factors affecting Kevin Harrington's net worth.

6. Career Trajectory

A career trajectory significantly influences an individual's net worth. The nature of employment, income generation capacity, and career progression directly impact the accumulation of wealth. A successful and well-compensated career path generally allows for greater savings and investment opportunities. Conversely, stagnant or less lucrative careers often constrain wealth accumulation. The overall trajectory of a career, encompassing its duration, progression, and associated compensation, is inextricably linked to the individual's financial standing. This relationship is demonstrably clear in various professions.

Consider the career of a professional athlete, for instance. Early-career earnings, combined with potential endorsements, contracts, and investment opportunities, often allow for significant accumulation. However, the career span is often finite, and the need for careful financial management becomes crucial. Furthermore, careers in high-demand fields, such as technology or finance, frequently offer higher compensation and greater potential for wealth building. These sectors often present opportunities for investment and salary advancement tied to performance, thereby impacting net worth. A detailed understanding of compensation structure, career growth potential, and typical longevity in a given field provides valuable insight into the likelihood of substantial wealth accumulation. This understanding is crucial for individuals evaluating potential career paths or for those already established in their chosen field.

In conclusion, career trajectory is a fundamental driver of net worth. The interplay of income generation, career progression, and career longevity significantly shapes financial standing. While inherent talent and external factors play a role, a well-structured and lucrative career path, coupled with strategic financial management, is vital for substantial wealth accumulation. Analyzing the connection between career trajectory and net worth allows individuals to make informed choices about their professional paths, leading to more successful and financially fulfilling careers. This underscores the importance of career planning and financial literacy for overall economic well-being.

7. Public Perception

Public perception of an individual, including their achievements, reputation, and overall image, can indirectly influence their perceived net worth. While not a direct determinant, public opinion can affect investment opportunities, brand value, and even perceived earning potential, all of which indirectly impact the estimated or reported financial standing of a figure like Kevin Harrington. A positive public image can attract investment and endorse lucrative ventures, while a negative one might deter opportunities and potentially reduce value.

- Brand Valuation and Endorsements

A positive public image enhances brand value. A highly regarded individual like Kevin Harrington, if perceived as trustworthy and successful, can command premium rates for endorsements. High public recognition can attract lucrative endorsement deals, which translate into higher income and increased overall perceived net worth. Conversely, negative publicity might severely impact endorsement opportunities, potentially reducing income and impacting the perceived value of assets.

- Investor Confidence and Market Sentiment

Public perception influences investor confidence. Positive media coverage, testimonials, or perceived success can boost investor confidence in an individual's ventures or investments, potentially leading to higher valuations or funding opportunities. Conversely, a negative perception could discourage investors, impacting the perceived market value of the individual's assets and influencing the calculation of net worth. This is especially true in publicly traded companies or ventures where investor confidence is a crucial factor.

- Perceived Earning Potential and Compensation Packages

Public perception plays a role in setting expectations for compensation. A highly regarded individual, often with a track record of success and achievement, may be perceived as deserving of higher earnings and compensation packages, even in the absence of tangible metrics. This perceived higher earning potential is indirectly reflected in estimates of net worth. Conversely, a negative perception could result in a lower estimation of their earning potential and affect their compensation, thereby indirectly affecting estimates of net worth.

- Impact on Investment Opportunities and Strategic Partnerships

Public perception can shape investment opportunities and partnerships. A positive image fosters trust and confidence, opening doors to lucrative investment opportunities and potentially strategic partnerships. Such relationships and the resulting financial success often influence the perceived net worth. A negative perception can make securing these opportunities challenging or impossible, negatively affecting the estimation of net worth.

In conclusion, public perception acts as a mediating factor in the complex relationship between an individual's actual financial standing and their perceived net worth. While not a definitive measure, a favorable public image can attract valuable opportunities and enhance the perception of financial success, whereas a negative one can have the opposite effect. This highlights the importance of reputation management and the impact public image can have on perceived financial worth, as seen in individuals like Kevin Harrington.

Frequently Asked Questions about Kevin Harrington's Net Worth

This section addresses common inquiries regarding Kevin Harrington's financial standing. The information presented is based on publicly available data and analysis. Interpretations and estimations should be considered with caution.

Question 1: What are the primary sources of Kevin Harrington's income?

Answer 1: Detailed specifics regarding income sources are not publicly available. However, a likely combination of earnings from his professional career, investments, and potential income streams from assets (including real estate or other holdings) are likely to contribute to his total financial standing.

Question 2: How is Kevin Harrington's net worth calculated?

Answer 2: Net worth is calculated by subtracting total liabilities from the sum of all assets. Publicly available information about specific assets or liabilities is limited, making precise calculation impossible.

Question 3: Is there publicly available data regarding Kevin Harrington's investments?

Answer 3: Specific details on Harrington's investment strategies and portfolio are typically not publicly reported. Public information relating to his financial activities may be limited, preventing a thorough analysis of investment performance and asset holdings.

Question 4: How reliable are estimations of Kevin Harrington's net worth?

Answer 4: Estimating net worth without detailed access to financial records involves significant estimation. Published figures are often approximations based on available information and various data points.

Question 5: Does Kevin Harrington's public image impact the perception of his net worth?

Answer 5: Yes. Public perception, reputation, and success narratives can impact the perceived value or attractiveness of investment opportunities tied to an individual. While not a direct calculation, this effect can shape public understanding and estimation of their wealth.

Question 6: How can individuals gain further understanding of Kevin Harrington's financial information?

Answer 6: Publicly available information related to Kevin Harrington's financial dealings is often limited. Direct access to financial records is not generally possible, preventing a complete understanding.

In summary, estimations of Kevin Harrington's net worth are based on publicly available information and various analytical approaches. The absence of detailed financial disclosures limits the accuracy of any assessment. Careful consideration should be given to the potential uncertainties inherent in estimates of this nature.

The following section will delve deeper into the factors influencing wealth accumulation and strategies for personal financial planning.

Strategies for Wealth Accumulation

Understanding the factors contributing to substantial wealth, like that of some high-profile figures, offers valuable insights. This section details actionable steps to enhance financial well-being and build wealth over time. The following strategies are general principles applicable across various socioeconomic backgrounds.

Tip 1: Prioritize Consistent Income Generation. A stable and reliable income stream forms the foundation of any successful financial strategy. Diversification of income sources, encompassing various employment avenues or investment strategies, strengthens financial security and reduces reliance on a single income source. Entrepreneurial pursuits, while potentially higher-risk, can offer substantial returns if successful.

Tip 2: Embrace Strategic Savings and Investment. Regular savings, even in small amounts, compounded over time contribute significantly to long-term wealth accumulation. Consistent investment in diversified financial instruments, such as stocks, bonds, and real estate, can yield significant returns if aligned with long-term financial goals.

Tip 3: Implement Prudent Expense Management. Careful management of expenses is crucial in achieving long-term financial security. Identifying and eliminating unnecessary expenditures, while ensuring essential needs are met, frees resources for savings and investments. A detailed budget, outlining income and expenses, facilitates strategic allocation of resources.

Tip 4: Develop Effective Debt Management Strategies. Minimizing high-interest debt, prioritizing debt repayment, and understanding the potential financial ramifications of various debt instruments can positively impact overall financial health. Seeking expert advice from qualified financial advisors is often recommended for this aspect.

Tip 5: Seek Professional Financial Guidance. Consulting with qualified financial advisors is essential in developing a comprehensive and personalized wealth management plan. These professionals can offer tailored advice based on individual circumstances, risk tolerance, and financial objectives.

Tip 6: Leverage Tax-Advantaged Accounts. Utilizing tax-advantaged accounts, like 401(k)s or IRAs, allows for tax-deferred growth of investments, which can substantially increase long-term wealth accumulation.

Tip 7: Maintain a Long-Term Perspective. Success in wealth building typically requires a long-term approach. Short-term market fluctuations should not deter consistent investment strategies. Consistency and patience are key virtues for navigating the complexities of financial markets.

Tip 8: Continuously Educate and Adapt. The financial landscape is dynamic, necessitating continuous learning and adaptation. Staying abreast of economic trends, financial regulations, and emerging investment opportunities is crucial to optimizing wealth accumulation strategies.

Following these strategies, while not guaranteed to achieve results similar to individuals like Kevin Harrington, can contribute to a more secure and robust financial future. Consistent effort, strategic planning, and proactive financial management are essential components in this process.

Conclusion

Assessing Kevin Harrington's net worth necessitates a multifaceted examination. Income sources, investment strategies, asset valuations, and expense management are key elements. Analysis reveals the complex interplay of career trajectory, public perception, and lifestyle choices in shaping an individual's financial standing. The relationship between public image and perceived financial success cannot be ignored. While specific financial details remain often elusive, the exploration underscores the significance of diverse factors influencing wealth accumulation. Understanding these interwoven components provides valuable context for evaluating individual economic positions, particularly those of high-profile individuals.

Ultimately, the analysis of Kevin Harrington's financial situation, or any individual's, underscores the need for careful financial planning and management. Consistent income generation, strategic investment, prudent expense management, and a long-term perspective are crucial elements in building and maintaining substantial wealth. This comprehensive approach to financial literacy empowers individuals to navigate the complexities of personal finance and make informed decisions toward achieving financial security and prosperity.

You Might Also Like

Trevon Diggs Net Worth 2024: Latest UpdateBrandy Piano Man MP4 Download Audio - Free Music Download

Asia Carrera: Age & Career Highlights

Ava Marie & Leah Rose Clements Parents: Exclusive Details

Tragic Loss: Naonobu Fujii, Deceased

Article Recommendations

- Hulk Hogan Vs Megan Fox Clash Of Icons In Popular Culture

- Trump Slams Mcconnell A Heated Showdown

- Andy Griffiths The Darlings Heartwarming Family Stories