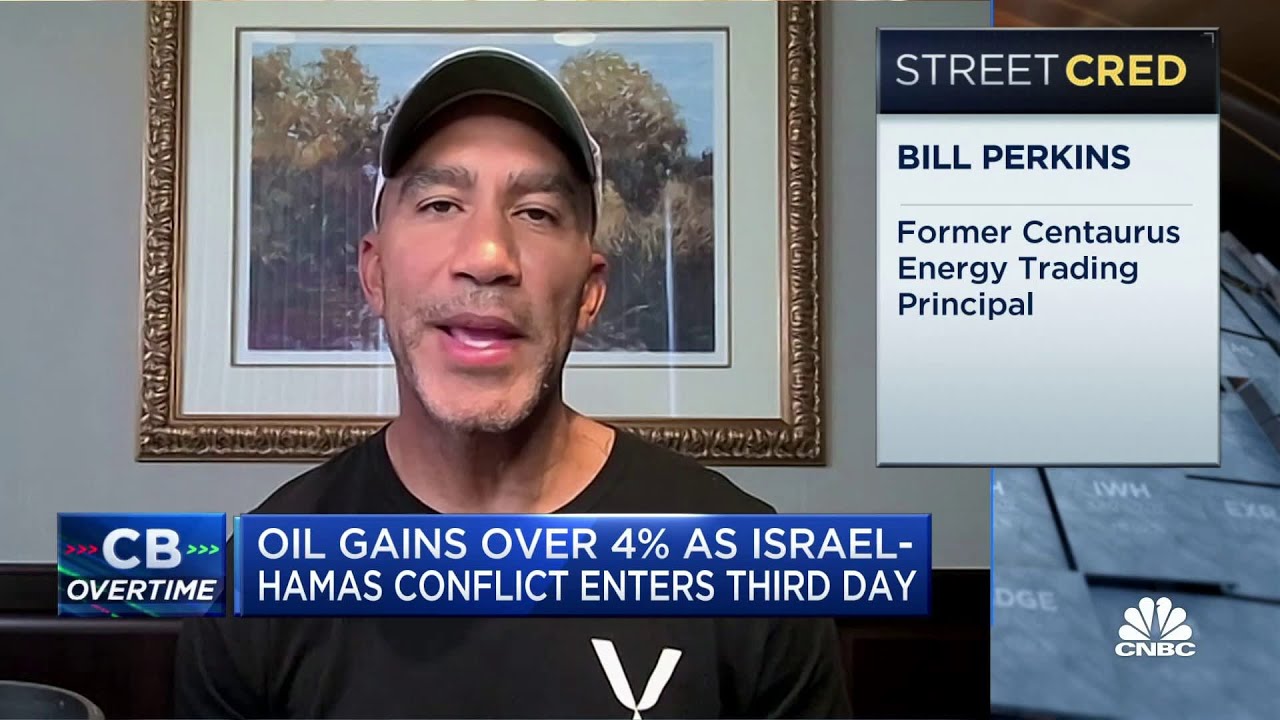

Bill Perkins Risks Oil Trade: Breaking Down the Strategy

Bill Perkins, a renowned oil trader, has recently made waves in the industry by employing a high-risk, high-reward trading strategy that has garnered both admiration and criticism.

Perkins' strategy involves placing large bets on short-term fluctuations in oil prices. He takes calculated risks, leveraging his expertise in the oil market to identify potential opportunities for significant profits.

Importance and Benefits:

Perkins' approach has the potential to generate substantial returns, as it capitalizes on market volatility and inefficiencies. However, it also carries significant risks, as traders can face substantial losses if market movements go against their positions.

Perkins' strategy has sparked debate within the trading community. Some admire his boldness and willingness to take risks, while others caution against the potential dangers of such an aggressive approach.

Historical Context:

Perkins' trading strategy is not entirely new. In the past, traders have employed similar high-risk, high-reward approaches in various markets, including stocks, currencies, and commodities.

Main Article Topics:

In this article, we will delve deeper into Bill Perkins' oil trading strategy, exploring its intricacies, risks, and potential rewards. We will also discuss the broader implications of such high-risk trading approaches within the financial markets.

Bill Perkins Risks Oil Trade

Bill Perkins' oil trading strategy involves taking calculated risks to capitalize on market inefficiencies. Here are eight key aspects to consider:

- High risk, high reward

- Short-term fluctuations

- Market volatility

- Oil market expertise

- Large bets

- Potential for substantial profits

- Potential for substantial losses

- Debate within trading community

Perkins' strategy requires a deep understanding of the oil market and a willingness to take on significant risk. While it has the potential for large profits, it is important to remember that losses can also be substantial. Perkins' approach has sparked debate within the trading community, with some admiring his boldness and others cautioning against the dangers of such an aggressive strategy.

1. High risk, high reward

In the world of finance, the adage "high risk, high reward" encapsulates the inherent relationship between risk and return. This principle is particularly relevant to Bill Perkins' oil trading strategy, as it involves taking calculated risks in pursuit of potentially substantial profits.

- Risk-taking and potential profits

Perkins' strategy involves placing large bets on short-term fluctuations in oil prices. This approach carries significant risk, as market movements can go against his positions, resulting in substantial losses. However, if his predictions are correct, he has the potential to generate significant profits. - Market volatility and risk management

The oil market is known for its volatility, which can create opportunities for high-risk traders like Perkins. However, this volatility also increases the risk of losses, making it crucial for Perkins to employ effective risk management strategies. - Expertise and risk assessment

Perkins' success as an oil trader is largely attributed to his deep understanding of the market and his ability to assess risk. He carefully evaluates market conditions, analyzes historical data, and considers geopolitical factors that may impact oil prices. - Risk-reward balance

Perkins' strategy exemplifies the delicate balance between risk and reward. While he is willing to take on significant risk, he also understands the importance of managing risk to protect his capital. His approach involves calculating the potential rewards and risks involved in each trade, ensuring that the potential profits outweigh the potential losses.

In summary, Bill Perkins' oil trading strategy epitomizes the high-risk, high-reward paradigm. By taking calculated risks, leveraging his expertise, and employing effective risk management techniques, he aims to capitalize on market volatility and generate substantial profits.

2. Short-term fluctuations

In the context of Bill Perkins' oil trading strategy, short-term fluctuations refer to the rapid and unpredictable changes in oil prices over relatively brief periods, typically ranging from minutes to hours or days. These fluctuations can be caused by a variety of factors, including news events, supply and demand dynamics, and geopolitical developments.

- Market volatility and trading opportunities

Short-term fluctuations in oil prices create opportunities for traders like Perkins to capitalize on market volatility. By identifying and predicting these fluctuations, traders can place bets on the future direction of prices and potentially profit from the resulting price movements. - Risk management and hedging strategies

While short-term fluctuations can provide trading opportunities, they also pose risks to traders. To mitigate these risks, Perkins employs various risk management strategies, such as setting stop-loss orders and hedging positions, to limit potential losses. - Expertise and market analysis

Perkins' success in navigating short-term fluctuations stems from his deep understanding of the oil market and his ability to analyze market data and identify trading opportunities. He closely monitors news, economic indicators, and geopolitical events that may impact oil prices. - High-risk, high-reward trading

Perkins' trading strategy, which involves placing large bets on short-term fluctuations, is inherently high-risk and high-reward. While it has the potential for substantial profits, it also carries the risk of significant losses.

In summary, short-term fluctuations in oil prices are a defining aspect of Bill Perkins' trading strategy. By leveraging his expertise, employing risk management techniques, and capitalizing on market volatility, Perkins aims to profit from these fluctuations while managing the inherent risks involved.

3. Market volatility

In the context of "bill perkins risks oil trade;", market volatility plays a pivotal role in shaping trading strategies and outcomes. Volatility refers to the extent of price fluctuations in a given market over time. In the oil market, volatility can be influenced by various factors such as supply and demand dynamics, geopolitical events, and economic conditions.

- Risk and Reward

Market volatility presents both risks and opportunities for traders. Perkins' trading strategy thrives on market volatility, as it allows him to capitalize on price swings and potentially generate substantial profits. However, this volatility also exposes him to the risk of significant losses if market movements go against his predictions. - Trading Opportunities

Volatility creates trading opportunities for traders like Perkins, who can identify and predict market movements and place bets accordingly. By analyzing market data, news, and geopolitical events, Perkins aims to stay ahead of the curve and seize these opportunities. - Risk Management

Managing risk is crucial in volatile markets. Perkins employs various risk management strategies, such as setting stop-loss orders and hedging positions, to mitigate potential losses and protect his capital. - Expertise and Market Analysis

Navigating market volatility effectively requires deep expertise and knowledge of the oil market. Perkins' success stems from his ability to analyze market data, identify trends, and make informed trading decisions based on his understanding of market dynamics.

In summary, market volatility is an integral aspect of Bill Perkins' oil trading strategy. By leveraging his expertise, employing risk management techniques, and capitalizing on market fluctuations, Perkins aims to generate profits while managing the inherent risks involved in volatile markets.

4. Oil Market Expertise

Oil market expertise is a cornerstone of Bill Perkins' successful oil trading strategy. It encompasses a deep understanding of the complex dynamics that drive oil prices, including supply and demand fundamentals, geopolitical events, and economic conditions.

- Market Fundamentals

Perkins has a thorough understanding of the oil market's fundamentals, including production costs, refining processes, and global supply chains. This knowledge enables him to make informed predictions about future price movements. - Geopolitical Analysis

Perkins closely monitors geopolitical events that may impact oil supply and demand, such as conflicts in oil-producing regions, changes in government policies, and international trade agreements. This analysis helps him identify potential risks and opportunities. - Economic Factors

Perkins considers macroeconomic factors such as global economic growth, inflation rates, and interest rate changes, which can influence oil demand and prices. By staying abreast of economic trends, he can anticipate market shifts and adjust his trading strategy accordingly. - Technical Analysis

Perkins employs technical analysis to identify patterns and trends in oil prices. He uses charts and indicators to study historical data and make predictions about future price movements. This analysis complements his fundamental and geopolitical insights.

In conclusion, Bill Perkins' oil market expertise is a critical component of his high-risk, high-reward trading strategy. By leveraging his deep understanding of market dynamics, he is able to make informed trading decisions and capitalize on market volatility.

5. Large Bets

In the realm of high-risk oil trading, "large bets" are an integral part of Bill Perkins' strategy. These bets involve committing substantial capital to specific trades, with the potential for both significant profits and substantial losses.

The rationale behind Perkins' large bets lies in his belief that market inefficiencies and short-term fluctuations can be exploited for profit. By placing large bets, he aims to maximize his gains when his predictions are correct. However, this approach also amplifies the potential for losses if the market moves against him.

Perkins' success in executing large bets stems from his deep understanding of the oil market, his ability to identify trading opportunities, and his robust risk management strategies. He carefully assesses market conditions, analyzes historical data, and considers geopolitical factors that may impact oil prices.

Moreover, Perkins employs strict risk management measures to mitigate potential losses. These measures include setting stop-loss orders to limit downside risk and hedging positions to reduce exposure to adverse price movements.

The practical significance of understanding the connection between large bets and Bill Perkins' oil trading strategy lies in the recognition that high-risk, high-reward approaches require a comprehensive understanding of market dynamics, effective risk management, and the ability to withstand potential losses.

6. Potential for substantial profits

In the realm of high-risk oil trading, the "potential for substantial profits" is a defining characteristic of Bill Perkins' strategy. It encapsulates the allure and inherent rewards that drive his bold approach to the market.

- Market Volatility and Profit Opportunities: The oil market is known for its volatility, presenting both risks and opportunities for traders. Perkins' strategy seeks to capitalize on this volatility by identifying short-term fluctuations and placing large bets on the direction of oil prices. By correctly predicting market movements, he has the potential to generate significant profits.

- Expertise and Market Analysis: Perkins' success in capturing profits stems from his deep understanding of the oil market and his ability to analyze historical data, market trends, and geopolitical events. This expertise enables him to make informed trading decisions and identify opportunities for substantial gains.

- High-Risk, High-Reward Approach: Perkins' trading strategy is inherently high-risk and high-reward. He is willing to take on significant risk in pursuit of potentially large profits. This approach requires a strong tolerance for risk and a willingness to accept the possibility of substantial losses.

- Risk Management and Mitigation: While the potential for substantial profits is a key aspect of Perkins' strategy, he also employs robust risk management measures to mitigate potential losses. These measures include setting stop-loss orders, hedging positions, and carefully calculating risk-to-reward ratios before entering trades.

In conclusion, the "potential for substantial profits" is an integral part of Bill Perkins' oil trading strategy. By leveraging his expertise, taking calculated risks, and employing effective risk management techniques, he aims to harness market volatility and generate significant profits while managing the inherent risks.

7. Potential for substantial losses

The "potential for substantial losses" is an inherent and unavoidable aspect of Bill Perkins' high-risk oil trading strategy. It represents the flip side of the high-reward potential that attracts traders to this volatile market.

Perkins' strategy involves placing large bets on short-term fluctuations in oil prices. While this approach has the potential for substantial profits, it also exposes him to the risk of significant losses if market movements go against his predictions. The oil market is notoriously unpredictable, influenced by a myriad of factors including geopolitical events, economic conditions, and supply and demand dynamics.

Perkins acknowledges and accepts the potential for substantial losses as an integral part of his trading strategy. To mitigate these risks, he employs robust risk management techniques, such as setting stop-loss orders and hedging positions. However, even with these measures in place, there is always the possibility of incurring substantial losses in this high-stakes trading environment.

Understanding the "potential for substantial losses" is crucial for anyone considering a similar trading strategy. It is essential to carefully weigh the risks and rewards, ensuring that the potential profits outweigh the potential losses. Traders must have a strong tolerance for risk and a sound understanding of the oil market before venturing into this high-risk, high-reward arena.

8. Debate within trading community

The "debate within trading community" surrounding Bill Perkins' oil trading strategy highlights the contrasting perspectives and opinions that exist within the financial markets. This debate sheds light on the inherent risks and potential rewards associated with such high-risk trading approaches.

Proponents of Perkins' strategy admire his boldness and willingness to take calculated risks in pursuit of substantial profits. They argue that his deep understanding of the oil market and his ability to identify short-term fluctuations give him an edge over other traders. Additionally, they point to his successful track record as evidence of the potential profitability of his approach.

Critics, on the other hand, caution against the dangers of such a high-risk strategy. They argue that Perkins' approach is akin to gambling and that he is exposing himself to unnecessary risks. They also point to the fact that even experienced traders can suffer substantial losses in the volatile oil market.

The debate within the trading community underscores the importance of carefully considering the risks and rewards involved in any trading strategy. It also highlights the need for traders to have a strong understanding of the market and to employ sound risk management practices.

Understanding the debate within the trading community is crucial for anyone considering adopting a similar high-risk trading approach. By weighing the arguments of both proponents and critics, traders can make informed decisions about the suitability of such strategies for their individual risk tolerance and financial goals.

FAQs

This section addresses frequently asked questions (FAQs) surrounding Bill Perkins' high-risk oil trading strategy, providing informative answers to common concerns and misconceptions.

Question 1: What is Bill Perkins' oil trading strategy?

Bill Perkins' oil trading strategy involves placing large bets on short-term fluctuations in oil prices. He leverages his expertise in the oil market to identify trading opportunities and aims to capitalize on market inefficiencies and volatility.

Question 2: Why is Perkins' strategy considered high-risk?

Perkins' strategy is considered high-risk because it involves placing large bets on short-term price movements. The oil market is inherently volatile, influenced by geopolitical events, economic conditions, and supply and demand dynamics, making it difficult to predict price fluctuations accurately.

Question 3: What are the potential benefits of Perkins' strategy?

The potential benefit of Perkins' strategy is the opportunity for substantial profits by capitalizing on market volatility. However, it is important to note that these profits are not guaranteed, and losses are also possible.

Question 4: What are the risks associated with Perkins' strategy?

The main risks associated with Perkins' strategy are the potential for substantial losses due to incorrect predictions of market movements. The oil market is unpredictable, and even experienced traders can suffer significant losses.

Question 5: How does Perkins manage risk in his strategy?

Perkins employs various risk management techniques, such as setting stop-loss orders and hedging positions, to mitigate potential losses. However, it is important to understand that risk management does not eliminate the possibility of losses in a high-risk trading strategy.

Question 6: Is Perkins' strategy suitable for all traders?

Perkins' high-risk oil trading strategy is not suitable for all traders. It requires a deep understanding of the oil market, a high tolerance for risk, and the ability to withstand potential losses. Traders should carefully consider their risk tolerance and financial goals before adopting such a strategy.

Summary: Bill Perkins' oil trading strategy involves high risks and potential rewards. While it has the potential for substantial profits, it is crucial to understand the inherent risks and employ sound risk management practices. Traders should carefully evaluate their risk tolerance and financial goals before considering such a high-risk strategy.

Transition: The following section will delve into the intricacies of Perkins' oil trading strategy, examining his risk management techniques and the factors that influence his trading decisions.

Tips from Bill Perkins' Oil Trading Strategy

Bill Perkins' high-risk oil trading strategy offers valuable lessons for traders seeking to navigate market volatility and capitalize on short-term fluctuations. Here are some key tips derived from his approach:

Tip 1: Understand the Market

Gain a deep understanding of the oil market's fundamentals, including supply and demand dynamics, geopolitical influences, and economic factors. This knowledge enables traders to make informed decisions based on a comprehensive analysis of market conditions.

Tip 2: Identify Trading Opportunities

Develop the ability to identify potential trading opportunities by studying historical data, market trends, and news events. Perkins' success stems from his ability to recognize inefficiencies and anticipate market movements.

Tip 3: Manage Risk Effectively

Implement robust risk management strategies, such as setting stop-loss orders and hedging positions. These measures help mitigate potential losses and protect capital in volatile market conditions.

Tip 4: Accept Potential Losses

Recognize that losses are an inherent part of high-risk trading. Accept the possibility of incurring substantial losses and adjust trading strategies accordingly to manage risk tolerance.

Tip 5: Stay Disciplined

Maintain discipline and adherence to trading strategies. Avoid emotional decision-making and stick to pre-defined risk parameters to enhance trading outcomes.

Tip 6: Learn Continuously

Continuously educate yourself about the oil market, trading techniques, and risk management practices. Ongoing learning is essential to adapt to changing market dynamics and improve trading strategies.

Tip 7: Use Technology

Leverage technology, such as trading platforms and analytical tools, to enhance trading efficiency and decision-making. Technology provides access to real-time data and facilitates the implementation of risk management strategies.

Tip 8: Seek Professional Advice

Consider consulting with experienced traders or financial advisors to gain insights and guidance. Professional advice can help refine trading strategies and enhance risk management practices.

Summary: By incorporating these tips into their trading approach, traders can increase their chances of success in navigating the high-risk, high-reward world of oil trading. Understanding the market, identifying opportunities, managing risk effectively, and embracing continuous learning are key elements of Perkins' successful trading strategy.

Transition: The following section will delve into a detailed analysis of Perkins' trading strategy, examining his decision-making process and the factors that influence his trades.

Conclusion

Bill Perkins' high-risk oil trading strategy exemplifies the intricate balance between potential profits and inherent risks in financial markets. His approach underscores the importance of market expertise, risk management, and the ability to capitalize on short-term fluctuations.

Perkins' strategy is not without its risks, and traders must carefully consider their risk tolerance and financial goals before adopting a similar approach. However, by understanding the principles behind Perkins' strategy and implementing robust risk management practices, traders can increase their chances of success in navigating the volatile oil market.

The lessons derived from Perkins' approach extend beyond oil trading and can be applied to various financial markets. His emphasis on market analysis, risk management, and continuous learning provides a valuable framework for traders seeking to navigate complex and unpredictable markets.

As the financial landscape continues to evolve, traders can draw inspiration from Bill Perkins' innovative and high-risk approach. By embracing a deep understanding of the markets, employing sound risk management techniques, and adapting to changing market dynamics, traders can position themselves for success in the ever-evolving world of finance.

You Might Also Like

Net Worth Revealed: Exploring The Wealth Of C. L. WernerHoward Tzvi Friedman: A Renowned Astrologer With Unparalleled Expertise

What Is Glenn O. Hawbaker's Net Worth?

What's Matt Friend's Net Worth?

Meet Bradley C Irwin: Expert In Your Industry

Article Recommendations

- Insights And Stories From The Tamron Hall Show

- Discover The True Identity Behind John Cena Uncovering His Real Name

- Woolsey Fire Damage 5725 Calpine Drive Malibu Photos Info