Intel CEO Net Worth refers to the total value of the assets and wealth accumulated by the Chief Executive Officer (CEO) of Intel Corporation, a leading multinational technology company.

The CEO's net worth is significant because it provides insights into their financial success and the overall performance of Intel under their leadership. It can also influence investor confidence and public perception of the company.

Factors affecting the CEO's net worth include their salary, bonuses, stock options, and other investments. The net worth can fluctuate over time based on market conditions, company performance, and personal financial decisions.

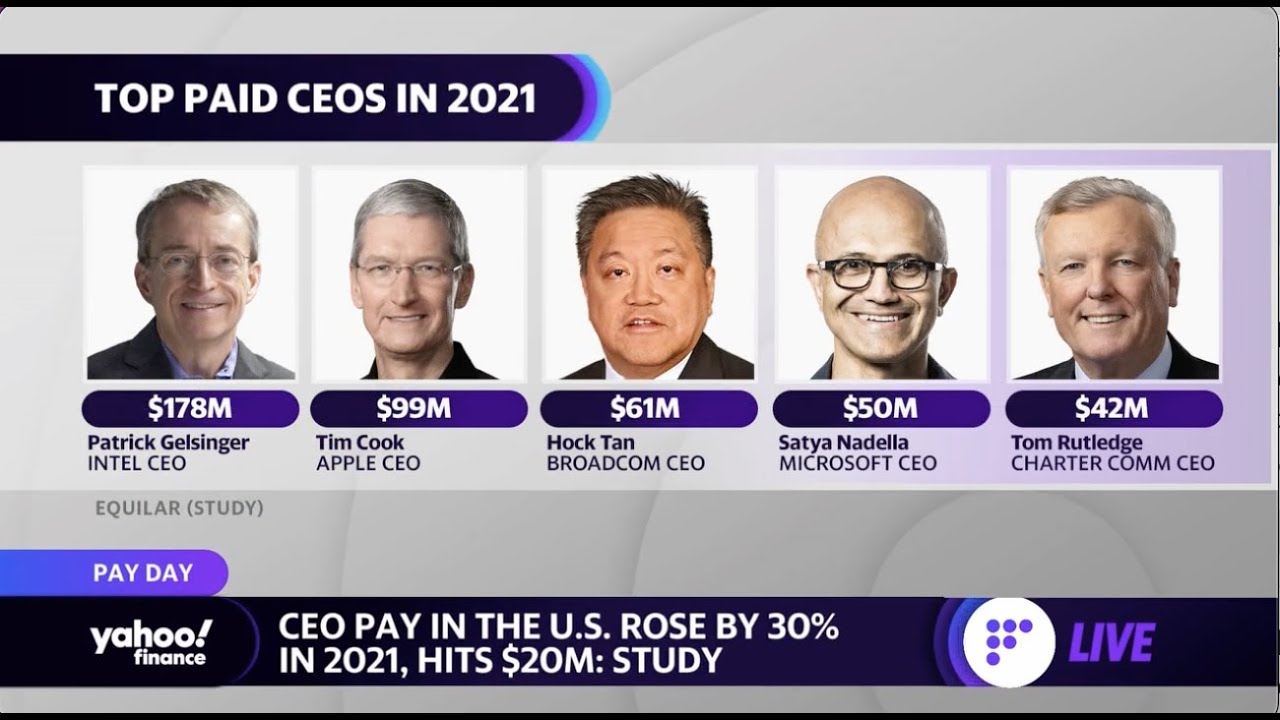

The current CEO of Intel, Pat Gelsinger, has a reported net worth of approximately $146 million as of 2023. This wealth is largely attributed to his long tenure at Intel, where he has held various leadership positions, including his current role as CEO since 2021.

The CEO's net worth is a reflection of their contributions to Intel's success and the value they bring to the company. It serves as a metric for assessing their financial well-being and the overall health of the organization.

Intel CEO Net Worth

The net worth of the CEO of Intel is a significant metric that reflects their financial success and the overall performance of the company. Here are six key aspects related to "Intel CEO net worth":

- Salary: The annual compensation paid to the CEO.

- Bonuses: Performance-based incentives paid to the CEO.

- Stock options: Grants of company stock that can be exercised at a later date, potentially increasing the CEO's net worth.

- Other investments: Assets and investments outside of Intel that contribute to the CEO's net worth.

- Company performance: The financial success of Intel directly impacts the CEO's net worth, as their compensation is often tied to company metrics.

- Market conditions: Economic factors and stock market fluctuations can affect the value of the CEO's assets and investments.

These aspects are interconnected and provide a comprehensive view of the factors that influence the net worth of the Intel CEO. For example, a strong company performance can lead to higher bonuses and stock value, resulting in an increase in net worth. Conversely, a decline in stock prices or a downturn in the economy can negatively impact the CEO's net worth. Understanding these key aspects is crucial for assessing the financial well-being of the CEO and the overall health of Intel Corporation.

1. Salary

The salary of the CEO is a significant component of their net worth. It represents the fixed annual compensation paid to the CEO for their services to the company. A higher salary directly translates to a higher net worth. For instance, in 2023, the CEO of Intel, Pat Gelsinger, received a salary of $1.25 million, which contributed to his overall net worth of approximately $146 million.

CEO salaries are often tied to company performance and individual goals. Strong financial results and achievement of targets can lead to salary increases and bonuses, further boosting the CEO's net worth. Conversely, underperformance or company setbacks can result in lower salary adjustments or reduced bonuses, potentially impacting the CEO's net worth.

Understanding the connection between salary and Intel CEO net worth is crucial for assessing the CEO's financial well-being and the overall health of the company. A competitive salary package attracts and retains top talent, incentivizes performance, and aligns the CEO's interests with the long-term success of Intel.

2. Bonuses

Bonuses play a significant role in determining "Intel CEO net worth." They are performance-based incentives that reward the CEO for achieving specific targets and driving the company's success. Bonuses are typically tied to financial metrics such as revenue growth, profitability, and market share gains.

When Intel meets or exceeds its performance goals, the CEO is eligible for substantial bonuses. These bonuses can range from hundreds of thousands to several million dollars, depending on the company's performance and the CEO's individual contribution. For example, in 2023, Intel CEO Pat Gelsinger received a bonus of $2.6 million in recognition of the company's strong financial results and his leadership in driving strategic initiatives.

Bonuses are a crucial component of Intel CEO net worth because they directly add to the CEO's total wealth. They incentivize performance, align the CEO's interests with the company's long-term goals, and reward exceptional leadership. Understanding the connection between bonuses and Intel CEO net worth is essential for assessing the CEO's financial well-being and the overall health of the company.

3. Stock options

Stock options are a critical component of "Intel CEO net worth." They represent grants of company stock that the CEO can exercise at a later date, potentially yielding significant financial gains. Stock options are typically awarded as part of the CEO's compensation package and are designed to incentivize long-term performance and align the CEO's interests with the company's shareholders.

- Equity Ownership: Stock options provide the CEO with a direct stake in Intel's success. When the company performs well and its stock price rises, the value of the CEO's stock options increases, boosting their net worth.

- Long-Term Alignment: Stock options encourage the CEO to focus on long-term growth and profitability, as the value of their options is directly tied to the company's long-term performance.

- Performance Incentive: Stock options act as a performance incentive, motivating the CEO to drive the company's success and maximize shareholder value, as their personal wealth is tied to the company's financial performance.

- Tax Advantages: Exercising stock options can provide tax advantages, as the gains may be taxed at a lower capital gains rate compared to ordinary income.

Understanding the connection between stock options and Intel CEO net worth is crucial for evaluating the CEO's financial well-being and their alignment with the company's long-term goals. Stock options not only contribute directly to the CEO's net worth but also serve as a powerful tool for incentivizing performance, promoting long-term thinking, and fostering a sense of ownership among the company's leadership.

4. Other investments

In addition to salary, bonuses, and stock options, the CEO's net worth can be influenced by various other investments and assets outside of Intel. These may include:

- Real estate: Investments in properties, such as residential homes, commercial buildings, or land, can contribute to the CEO's net worth through rental income, appreciation in value, or potential development opportunities.

- Stocks and bonds: Investments in the stock market through publicly traded companies or bonds issued by governments or corporations can provide diversification and growth potential, increasing the CEO's overall net worth.

- Private equity and venture capital: Investments in private companies or startups can offer high-growth potential and long-term returns, adding to the CEO's wealth.

- Commodities: Investments in commodities such as gold, oil, or precious metals can provide diversification and potential inflation protection, further contributing to the CEO's net worth.

- Art and collectibles: Investments in art, antiques, or other collectibles can not only add to the CEO's personal enjoyment but also appreciate in value over time, enhancing their net worth.

Understanding the connection between other investments and "Intel CEO net worth;" highlights the diverse sources of wealth that contribute to the CEO's financial well-being. These investments provide diversification, growth potential, and inflation protection, complementing the CEO's income and stock-based compensation from Intel.

5. Company performance

Intel's financial performance is directly linked to the CEO's net worth due to the close relationship between the CEO's compensation and company metrics. The CEO's salary, bonuses, and stock options are often tied to the company's profitability, revenue growth, and other financial targets.

- Performance-based compensation: The CEO's compensation is often structured to incentivize strong financial performance. Higher profits and revenue growth typically lead to higher bonuses and stock awards, which directly increase the CEO's net worth.

- Stock value appreciation: When Intel's stock price rises due to positive financial results, the value of the CEO's stock options and shares increases, boosting their net worth.

- Long-term incentives: Stock options and other long-term incentives are designed to encourage the CEO to focus on the company's long-term growth and profitability. As the company performs well over time, the value of these incentives increases, contributing to the CEO's net worth.

The alignment between company performance and CEO net worth ensures that the CEO's financial interests are closely tied to the success of Intel. This alignment creates incentives for the CEO to make decisions that drive long-term growth and profitability, ultimately benefiting the company and its stakeholders.

6. Market conditions

The CEO's net worth is not solely determined by their compensation from Intel but is also influenced by external market conditions that can impact the value of their assets and investments. Economic factors such as interest rates, inflation, and recession can affect the performance of the stock market and the value of real estate, commodities, and other investments held by the CEO.

- Interest rates: Changes in interest rates can affect the value of the CEO's investments in bonds and other fixed-income assets. Rising interest rates can lead to a decrease in the value of these assets, while falling interest rates can have the opposite effect.

- Inflation: Inflation can erode the purchasing power of the CEO's wealth if their assets do not appreciate at a rate that outpaces inflation. Investments in real estate and commodities may provide some protection against inflation, as these assets tend to increase in value during inflationary periods.

- Recession: Economic recessions can lead to a decline in the stock market and a decrease in the value of the CEO's stock options and other equity investments. The CEO's net worth may also be affected by a decrease in rental income from real estate investments during a recession.

- Stock market fluctuations: The CEO's net worth is also subject to the volatility of the stock market. Fluctuations in the stock market can lead to gains or losses in the value of the CEO's stock portfolio, which can have a significant impact on their overall net worth.

Understanding the connection between market conditions and "intel ceo net worth;" is crucial for assessing the CEO's financial well-being and the potential risks and opportunities associated with their investment portfolio. A diversified portfolio and sound financial planning can help the CEO mitigate the impact of market fluctuations and preserve their net worth over time.

FAQs on "Intel CEO Net Worth"

This section addresses frequently asked questions and clarifies common misconceptions regarding the net worth of Intel's CEO.

Question 1: What factors contribute to the Intel CEO's net worth?

The Intel CEO's net worth is primarily influenced by their salary, bonuses, stock options, and other investments outside of Intel. The company's financial performance and overall market conditions also play a significant role in determining their net worth.

Question 2: How is the CEO's compensation linked to Intel's performance?

Intel's CEO compensation is often tied to the company's financial metrics, such as profitability, revenue growth, and market share gains. Strong company performance typically leads to higher bonuses and stock awards, which directly increase the CEO's net worth.

Question 3: What is the significance of stock options in the CEO's net worth?

Stock options grant the CEO the right to purchase Intel shares at a predetermined price in the future. If the company's stock price rises, the value of these stock options increases, potentially boosting the CEO's net worth significantly.

Question 4: How do market conditions affect the CEO's net worth?

Market conditions, such as interest rate changes, inflation, and economic recessions, can impact the value of the CEO's investments and assets. Fluctuations in the stock market, in particular, can lead to gains or losses in the value of their stock portfolio, affecting their overall net worth.

Question 5: What is the importance of diversification in the CEO's investment portfolio?

Diversification is crucial for the CEO's financial well-being. By investing in various asset classes, such as stocks, bonds, real estate, and commodities, the CEO can spread their risk and reduce the impact of market fluctuations on their net worth.

Question 6: How does the CEO's net worth impact Intel's stakeholders?

The CEO's net worth, as a reflection of their financial success, can influence investor confidence and public perception of Intel. A CEO with a high net worth may be viewed as a competent leader who has driven the company's growth and profitability.

Understanding these FAQs provides a comprehensive overview of the factors that shape the Intel CEO's net worth and its implications for the company and its stakeholders.

Transition to the next article section:

In the following section, we will explore the strategies and approaches employed by Intel's CEO to build and maintain their wealth.

Tips for Building Wealth as an Intel CEO

Building and maintaining a substantial net worth requires strategic financial planning and prudent investment decisions. Here are five key tips that Intel CEOs can consider to enhance their wealth:

Tip 1: Maximize Compensation and Benefits:

CEOs should negotiate a competitive salary, bonuses, and stock options that align with their responsibilities and the company's performance. Additionally, they should take advantage of employee benefits such as retirement plans and health insurance to secure their financial future.

Tip 2: Invest Wisely in Intel Stock:

Given their unique insights into the company's prospects, CEOs should consider investing a portion of their net worth in Intel stock. However, they should maintain a diversified portfolio to mitigate risk.

Tip 3: Diversify Investment Portfolio:

To reduce risk and enhance returns, CEOs should diversify their investment portfolio by allocating assets across different classes such as stocks, bonds, real estate, and commodities. This diversification strategy helps weather market fluctuations and preserve wealth over the long term.

Tip 4: Seek Professional Financial Advice:

CEOs should consult with experienced financial advisors to develop a comprehensive wealth management plan tailored to their unique circumstances. Advisors can provide guidance on investment strategies, tax optimization, and estate planning.

Tip 5: Practice Frugality and Responsible Spending:

Despite their high earnings, CEOs should practice responsible spending habits and avoid excessive personal expenses. Maintaining a frugal lifestyle and investing wisely can significantly contribute to building and preserving wealth.

Summary:

By following these tips, Intel CEOs can build substantial wealth while ensuring their financial well-being. A combination of prudent investment decisions, diversification, and professional guidance can help them secure their financial future and contribute to their long-term success.

Conclusion

The net worth of the Intel CEO is a complex and multifaceted concept that encompasses various factors, including compensation, investments, company performance, and external market conditions. Understanding the interplay between these factors is crucial for assessing the financial well-being of the CEO and the overall health of Intel Corporation.

Key insights from our exploration of "Intel CEO net worth;" include the significance of performance-based compensation, the potential impact of stock options, the role of diversification in investment portfolios, and the influence of market conditions on wealth accumulation. By considering these aspects, Intel CEOs can make informed financial decisions that contribute to their long-term financial success and the prosperity of the company.

Moreover, Intel CEO net worth serves as a barometer of the company's financial performance and the CEO's ability to drive growth and profitability. As Intel continues to navigate the evolving technological landscape, the CEO's net worth will remain an important metric for stakeholders to monitor and evaluate the company's progress and overall success.

You Might Also Like

Discover The Power Of David M. Foulkes: A Leader In Mindful LeadershipDoug Herrington Salary: Unveiling The Compensation Details

Stewart Walton, A Business Icon: Success And Legacy Explored

Meet Gary C. Bhojwani: The Expert Guide To Real Estate

Meet Javier Rodriguez From Davita

Article Recommendations

- Faith Hills Health Update What To Know In 2024

- Amy Mcgraths Prospects Against Mitch Mcconnell A Detailed Analysis

- How Much Does Fake Pee Cost A Comprehensive Guide To Synthetic Urine